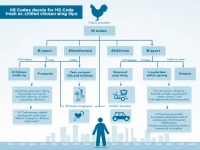

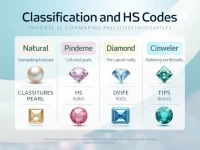

Customs Brokerage Key to Import Business Efficiency

This article discusses the core concepts of customs operations and the responsibility relationship between importers and customs brokers. It emphasizes the importance of responsibility supervision for ensuring compliance and efficiency, while also highlighting the necessity of communication and risk management within the complex trade environment.